Ignorance is Financial Bliss

|

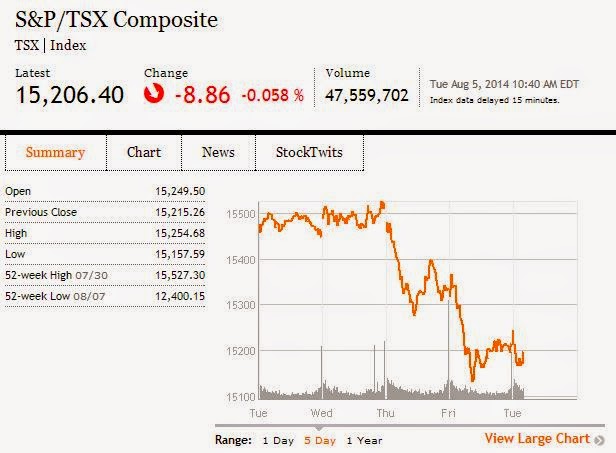

| That is quite the drop from Wednesday. |

Last week, we transferred some money into wifey's RRSP at Questrade. After updating and inputting current market data, I calculated the number of ETFs we needed to purchase to rebalance her portfolio and purchased the ETFs.

Afterwards, I updated some spreadsheets and got a sense of where we were in terms of how we were doing with our investments. Overall, a decent picture.

This morning, on my way to work, I heard the business report on the radio. The business editor was saying something along the lines of the markets in the US were on the positive side after a huge sell of at the end of last week.

Wait, there was a sell off?

Curious about this sell off, I clicked around a few news sites and poked around. Apparently, last Thursday and Friday the markets reacted badly to some "crisis" or another and started selling their stocks. This resulted in a fairly dramatic drop in prices.

Of course, I had no idea. I just purchased the ETFs since we contributed money to wifey's accounts.

Additionally, looking through past charts, it also appears the previous two weeks before the sell off were very good for the markets.

Again, I had no clue. Just before this climb in the market, I transferred money to both our accounts and purchased the ETFs I was supposed to.

Well what does this mean? With all the ups and downs, it has to mean something right?

Actually, it doesn't. Not unless you intend to sell your investments. If you're young like me and are looking to retire early, you would be buying stocks (or ETFs in my case) and holding it.

Could stocks drop even further?

Of course it could. If you purchase on a schedule (like every payday) why does it matter if it drops further after you purchase? It just means you can purchase more later when prices are lower.

Ideally, we buy low. But there's no way to tell when that is. The only thing you can do is buy on a schedule or when you can contribute any money to your investments.

Sadly, will all this volatility, there are some people who saw the prices go up and bought into the markets (with dollar signs flashing in their eyes) when the markets were on the high. Then they (likely) proceeded to sell when prices dropped out of fear this was a prelude to a huge market correction*.

No, no one can be that silly right?

Well, the graphs and charts don't lie. Prices go up because more people are buying than selling. Prices go down because more people are selling than buying.

So how did I stay out of this mess?

I don't really care. I'm blissfully ignorant of the daily happenings of the stock markets.

Stocks went up? No clue, I was busy spending time with wifey.

Stocks went down? No idea, I was busy with a project at work.

I think you get the point. I have no clue what is going on. Once in a while, I might see the investment amount in Mint change up or down. But usually, it's a couple dollars. What are a couple of dollars going to do when it costs a minimum of $4.95 to sell ETFs?

The best thing you can do with your investments is to just leave them alone. Buy and hold. Stay ignorant of business news and forecasts. Stick to your plan.

*Seems a lot of articles are spewing statistics that there hasn't been a major market correction in over 1000+ days or something along those lines and that we are long overdue. Of course, anyone reading this would fear a correction when stocks dropped as much as they did last Thursday and Friday. I don't give much credence to these business reports. The housing bubble in Canada was supposed to burst sometime in 2010 after the Vancouver Olympics, and in 2011 for some reason or another, and in 2012 because the output from the Santa Claus workshop was lower than expected the previous Christmas... yada, yada, yada. Of course, it's 2014 now and we're still waiting for the bubble to burst. Anyone waiting for the bubble to burst now have to save more of a down payment as prices continue to go up.

Comments

Post a Comment