When Bad Situations Get Worse...

|

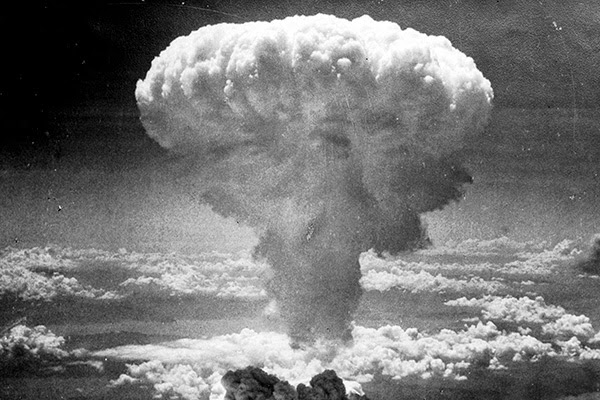

| ...it's like a nuclear bomb went off. |

Now that that's cleared up...

Holy cow!

Remember that couple I profiled a while ago? The couple who continued to spend money like they still had two incomes?

Well, seems the wife of that couple told wifey a few more details. In turn, wifey shared those details with me.

Seems this couple (let's call them Jay and Thea) paid $300,000 for their house. Assuming regulations required them to put down a 5% down payment towards the house, that means their mortgage is around $285,000. With this mortgage, seems their monthly mortgage payment is about $2,200.

Holy cow!

That's much more than what we pay on a per month basis and we borrowed more than they did. However, we did put down more than 20% for our down payment, so we avoided paying for the mortgage insurance. I also never filed for bankruptcy (seems Jay has), so wifey and I qualified for interest rates that were likely than the ones they qualified for.

Anyway, continuing with these details, seems the Thea's salary isn't enough to cover their monthly fixed expenses.

To make matters worse, seems Jay's old company required teams to attain certain sales targets. Since the work place got shut down, sales could not be made. Obviously, this meant that certain sales targets could never be reached. That meant the pay they expected would be further reduced. Yes, this makes no sense to me. That's not for me to argue for. As a result, the former company informed the Government that the husband would get severance until October but would actually only get a reduced pay until August.

This brings up another matter. Due to the company informing the Government that Jay was getting severance until October, Jay was informed he wasn't eligible for EI until October.

That's not even all of it.

To compound things even more, Jay recently suffered another hernia. He's recovering now, but won't be able to look for work for at least a month or so.

Yikes! When things go bad, they go really bad.

If this isn't a wake up call, I'm not sure what is.

However, seems Jay and Thea don't have many options available. It appears all the motorcycles Jay owns contain negative equity. Negative equity is just a fancy word for debt. So essentially, the bikes are worth less than he owes on them. In order to sell the bikes, he'd have to take less from a buyer and then come up with the cash to pay the lender the difference.

If it wasn't obvious before, they don't have the cash for one bike. Forget the fact that they have three negative equity motorcycles.

Remember that truck they got? Seems that was financed as well. If he were to sell that truck, he would get much less than what he owed as well.

The only other option would be to sell the house. However, with their credit history (not to mention lack of first and last months rent, security deposit, and the fact they would need a pet friendly rental), that would essentially leave them homeless. Additionally, it doesn't appear selling the house would cover all their debts. I'm not too clear on their finances as everything I've been hearing has been second hand.

So how did it get this bad? Just last year, they invited us to their house for a house warming party and everything was golden.

While I don't know the exact reasons, I could chalk it up to the following:

- Spending more than they make (despite two full time incomes)

- Financing cars and motorcycles

- No (more?) savings

- They both went insane with home renovations (Diderot effect anyone?)

- No discussion about their finances

When one of them lost their job (in this case, it was Jay), it was just a matter of time before everything else crumbled around them.

There's still a chance for this couple, Jay has a lot of stuff he can sell. They need to make up the shortfall between August and October. This is one way to do it.

They'll also need to cut their variable expenses as much as they can. If there's a way, they should slash the amount they pay for insuring their five vehicles. He's the only one who drives. Realistically, they only need one car. Assuming insurance is split equally five ways, that's a savings of 80%. It's probably not that simple, but there are real savings to be had in insurance.

Unfortunately, that's all I can say about this situation. Not knowing exactly where their money is going, it's hard to find solutions to their problems.

In contrast, this is our (wifey and me) situation:

- We're spending around 60% of what we take home.

- We don't have any financed cars.

- We have enough savings for 6 months expenses if both of us lost our jobs. This is assuming we keep spending the same amount monthly with no cut backs. Theoretically, we can stretch our savings to survive at least one year without income*.

- We have made zero major renovations to our house. We've made small changes here and there. Nothing crazy.

- We discuss our finances often.

This puts wifey and me in a better position to deal with unforeseen circumstances.

Personally, I hope it never comes to that, but considering what is happening with her friends, anything is certainly possible.

*I'm not including any possible EI payments in my calculations. For now, I'm going to pretend it's not an option.

Comments

Post a Comment