Filing Your Taxes For Free

|

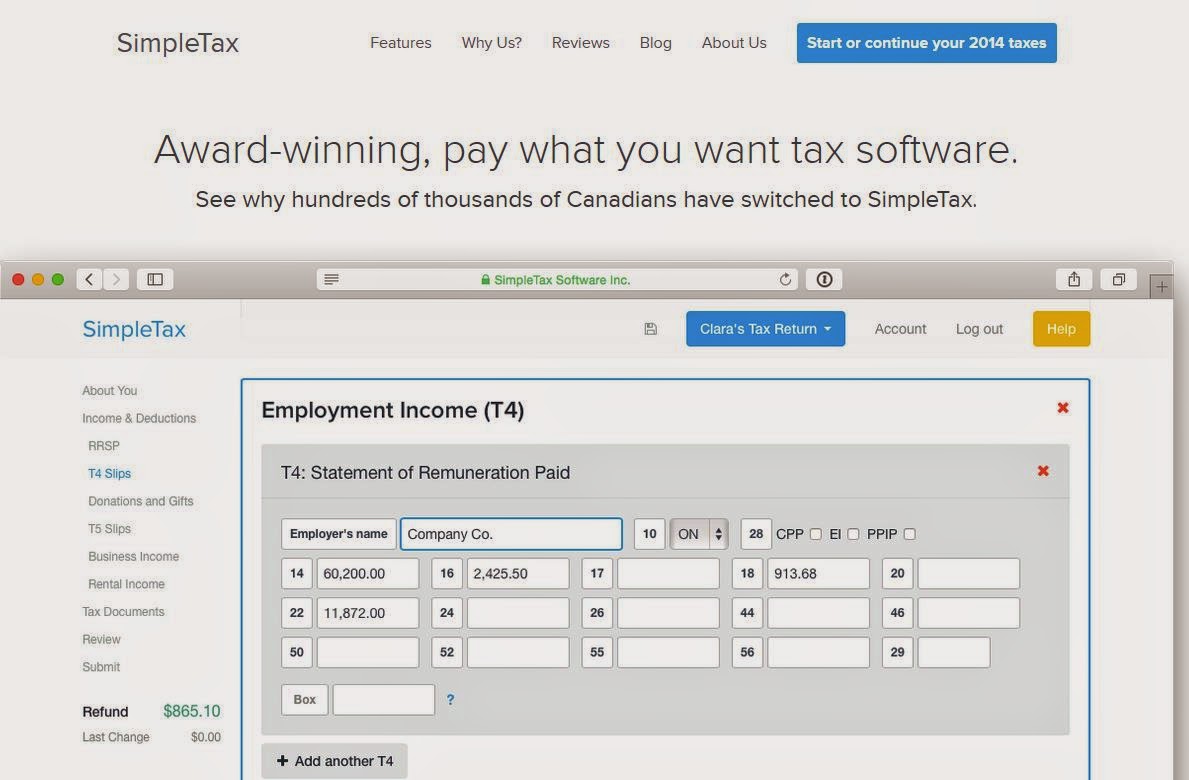

| We used SimpleTax this year. It was... simple. |

In previous years, I would go to a Canada Post outlet, pick up a tax guide plus a booklet of forms, gather all my receipts, and crunch the numbers. After I was done, I'd put the numbers on the forms, throw the forms and receipts into the envelope, and head back to the Canada Post outlet to mail the tax return to the Canada Revenue Agency Office in Sudbury.

After a month or so, wifey and I would get our refund deposited directly into our bank accounts. Generally, in late April. Mid-April if we were fortunate.

There was the option of purchasing tax software, but they usually sell for $40 (or more depending on the name). Some go as low as $10, but those typically come with restrictions such as basic returns only. I don't know what a basic return is, so I just put pencil to paper and spend a night calculating.

Fortunately, something happened last year that changed everything. When wifey went to pick up some tax forms at a Canada Post office near her work, the employee there offered to give wifey free tax software. Wifey declined and picked up a couple of booklets anyway. However, she did tell me about it. As I was in the habit of filing on paper, I still filed the 2013 return by hand. However, I told myself I would investigate the "free" software thing for 2014.

As 2014 came to a close and RRSP season got underway, I started looking at tax software options. I found the Certified software page on the CRA website. There are many options here. A lot of them free. After looking through some of the options, I settled on SimpleTax mainly because the interface was aesthetically pleasing. Seriously. It looks like something from 2015 and not 2000. It was also an online offering. I didn't want to download and install tax software on my computer.

But if this is online only product, isn't your information at risk?

Possibly. However, as long as computers are connected to the Internet, all information is at risk. Remember the Heartbleed bug that forced the CRA to shutdown for a week last year? Or Home Depot's security breach?

The only thing you can do is mitigate the risks.

First is inspecting the security certificate of the website. With Google Chrome, it's a simple matter of clicking the green box that appears beside the link.

They are who they say they are. At least according to DigiCert SHA2 Extended Validation Server CA (likely this CA stands for Certificate Authority). Basically, this organization is acting as a third party to say, "Yes, these people are who they say they are."

As such, that means all connections to their website are encrypted. As long as there is an https in the link (the s stands for secure), no one will be able to see what is being sent between the web server and your computer.

But what about information stored on their server?

That's trickier. According to their FAQ page, all data on their server is encrypted. Not only that, but the data is encrypted with the password we select. As long as we don't share the password with someone or use the same password on other sites, it shouldn't be an issue.

But don't they have they password stored on their server?

Yes and no.

They likely have the password stored on their server, but even the password is encrypted (generally hashed). Ever notice how most Forgot Passwords links send you a link to create a new password rather than send you the password? Some even send you a new temporary password.

This means the server cannot recover your password as it is encrypted and this encryption only works one way*.

Okay, enough with the technical talk.

After creating a username and password, you need to create profiles for the people you intend to file for. In my case, I created profiles for wifey and myself. After that, I selected the profile and answered some of the questions asked. These questions help the software determine your eligibility for tax credits and other programs. Afterwards, I started entering tax receipts into the system. You just select the receipt type (T4, T5, etc.) and fill out the numbers in the appropriate boxes.

This process takes about 15-20 minutes depending on the number of receipts you have and how fast you can navigate a computer.

When you're done with everything, don't forget to enter other items like transit pass credits or RRSP contributions.

Now you Optimize your return and go through the checklist to ensure you're not missing something that can give you more money on your refund.

When you're certain you're finished, you can hit Submit and that's that!

You'll need to hit Submit for each profile you set up, but that's not a big deal. The CRA NETFILE system probably requires each return to be submitted one at a time.

Once you hit submit, you are asked for a donation.

Yes, this software is free to use. You can choose to donate nothing. However, it would be a Scumbag Steve (or Stacy) to use the software for free and not give the software creators a little something to thank them for their good work.

After all, good software doesn't write itself.

I chose to donate something as it did save me a lot of time dealing with the capital gains and dividends portion of the tax return. I also saved money by not sending the return via Canada Post. Additionally, by not grabbing any paper forms, I saved some of my tax dollars for better uses like the ads for Canada's Economic Action Plan!

After you donate (or not), you are given a confirmation number and have the option to save your tax return (in pdf format) to your computer. I saved both returns and that was that.

Another benefit of submitting online is that you get your return assessed much quicker.

Wifey and I submitted our return on March 9th. It was marked as received right away on CRA's My Account portal. After a few days, it was marked as assessed and information provided on the site indicated that a refund would be deposited to our bank accounts on the 19th. Well, that's today! The refund was received 10 days after we submitted! The CRA also sent us an email to view our Notice of Assessment online.

As long as there are free offerings for tax filing software, I don't think I'll ever go back to paper. I've shared this site with friends and family, they all seem to like using it too.

Kind of makes you wonder why we all filed paper returns for so long.

*If a Forgot Password link ever sends you your password in plain text, it's best to ensure that password is unique to that website (or even delete your account and stop using the website). If you use the same password for many other sites (like online banking), then there's a chance your account can be compromised if their server is compromised.

Comments

Post a Comment