Renewing Your Mortgage

|

| Current Prime rate is 2.70% |

As we used a mortgage broker last time, we felt it was important to use them again to help us get the best rate possible.

After sending them our updated information, they told us to wait until our mortgage company sent us the renewal documents.

Funny enough, two days later, I was contacted by the mortgage company and we discussed what we were looking for in the renewal.

A few questions that were asked.

Now, the last time we selected a variable rate, the Bank of Canada cut interest rates twice. The first was January 2015 and the second time in July 2015. So, we did well to select a variable rate mortgage at the time.

Two years after the cuts, the economy is still struggling. Oil is still no where near the record highs of June 2014 and is currently priced at $49 a barrel, only up $1 from January 2015. Jobs are increasing, but only temporary or part-time employment. Full time positions haven't been increasing and it would appear companies aren't hiring for these positions any more.

As a result, it seems unlikely the Bank of Canada will increase rates anytime soon, despite the fact the US has increased interest rates twice this year alone. It also seems unlikely the Bank of Canada will cut interest rates again. As it stands, this effectively makes a variable rate mortgage into a fixed rate mortgage.

After explaining to the representative at our lender, what we wanted, I also explained to her we were planning on using a broker like the previous time to secure us a favourable interest rate.

I don't know if that made a difference or not, but the first offer I was given was prime minus 0.65%. As the prime rate is currently 2.70%, this would make our interest rate 2.05%. Wow. Currently, we have prime minus 0.10%, so our current rate is 2.60%. We'd be saving 0.55%.

If, hypothetically, the Bank of Canada were to increase the overnight rate from 0.5% to 1.0% in a span of 12 weeks, we'd still be at a lower interest rate (2.55% vs 2.60%).

I forwarded this information to my broker. While it was a strong initial offer, they were willing to stand pat for a better offer from other lenders.

A couple weeks passed before I was contacted again by the representative at our lender. She offered another rate of prime minus 0.70% this time. Making the new rate 2.00%. I forwarded this information to our broker and they thanked me for the update.

That same afternoon, the representative sent me another updated rate of prime minus 0.75%! The same afternoon. I forwarded the updated rate again to our broker and right away, they told me to accept the renewal offer as lenders didn't even offer them rates that low.

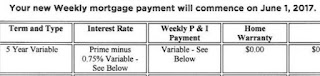

So that was that. Wifey and I initialed and signed the renewal documents and forwarded it to our lender. Our interest rate effective June 1, 2017 will be 1.95% (0.65% lower than our current rate).

I expected the mortgage renewal process to be more difficult than that. I guess we were fortunate our lender was willing to offer us a great rate without having to jump through hoops, or redo the entire application process. I suppose the fight for mortgages is pretty tight.

Based on the lower rate and the lower amortization (from the previous mortgage prepayments), we'll be paying $35 less each week than when we first signed up for a mortgage 5 years ago. However, like before, we'll be paying the same amount. This means we'll paying off an extra $1,820 a year without even having to think about it. Or an extra $9,100 for the 5 year term. Assuming, the interest rates stay the same over the course of 5 years. Seems unlikely, so we'll see.

In any case, don't accept the first rate offered by your lender. Plus, it's always better to shop around for the lowest rate possible.

A few questions that were asked.

Are you looking to do a straight renewal or are you considering borrowing additional money and would you be interested in another variable term or are you and Wifey leaning towards a different option for your new term?Okay, really just one long question. Our situation was very simple, we just wanted a straight renewal with a similar variable term for 5 years. Also, the question of borrowing more money was also asked by my broker when they were updating our profile. I suppose a lot of people get into trouble with consumer debt and need to tap into their home equity to pay off these loans. Fortunately for wifey and I, we have no such debts and were able to just continue with a straight renewal.

Now, the last time we selected a variable rate, the Bank of Canada cut interest rates twice. The first was January 2015 and the second time in July 2015. So, we did well to select a variable rate mortgage at the time.

Two years after the cuts, the economy is still struggling. Oil is still no where near the record highs of June 2014 and is currently priced at $49 a barrel, only up $1 from January 2015. Jobs are increasing, but only temporary or part-time employment. Full time positions haven't been increasing and it would appear companies aren't hiring for these positions any more.

As a result, it seems unlikely the Bank of Canada will increase rates anytime soon, despite the fact the US has increased interest rates twice this year alone. It also seems unlikely the Bank of Canada will cut interest rates again. As it stands, this effectively makes a variable rate mortgage into a fixed rate mortgage.

After explaining to the representative at our lender, what we wanted, I also explained to her we were planning on using a broker like the previous time to secure us a favourable interest rate.

I don't know if that made a difference or not, but the first offer I was given was prime minus 0.65%. As the prime rate is currently 2.70%, this would make our interest rate 2.05%. Wow. Currently, we have prime minus 0.10%, so our current rate is 2.60%. We'd be saving 0.55%.

If, hypothetically, the Bank of Canada were to increase the overnight rate from 0.5% to 1.0% in a span of 12 weeks, we'd still be at a lower interest rate (2.55% vs 2.60%).

I forwarded this information to my broker. While it was a strong initial offer, they were willing to stand pat for a better offer from other lenders.

A couple weeks passed before I was contacted again by the representative at our lender. She offered another rate of prime minus 0.70% this time. Making the new rate 2.00%. I forwarded this information to our broker and they thanked me for the update.

That same afternoon, the representative sent me another updated rate of prime minus 0.75%! The same afternoon. I forwarded the updated rate again to our broker and right away, they told me to accept the renewal offer as lenders didn't even offer them rates that low.

So that was that. Wifey and I initialed and signed the renewal documents and forwarded it to our lender. Our interest rate effective June 1, 2017 will be 1.95% (0.65% lower than our current rate).

I expected the mortgage renewal process to be more difficult than that. I guess we were fortunate our lender was willing to offer us a great rate without having to jump through hoops, or redo the entire application process. I suppose the fight for mortgages is pretty tight.

Based on the lower rate and the lower amortization (from the previous mortgage prepayments), we'll be paying $35 less each week than when we first signed up for a mortgage 5 years ago. However, like before, we'll be paying the same amount. This means we'll paying off an extra $1,820 a year without even having to think about it. Or an extra $9,100 for the 5 year term. Assuming, the interest rates stay the same over the course of 5 years. Seems unlikely, so we'll see.

In any case, don't accept the first rate offered by your lender. Plus, it's always better to shop around for the lowest rate possible.

Comments

Post a Comment