Company Shares: Sell or Transfer?

One of the benefits available at her old company was the Employee Share Purchase Plan (ESPP). During each pay period, employees could contribute up to 10% of their paycheque to purchase shares. The company would then provide a match of 33% of whatever the employee contributed. The employee wouldn't be able to sell the shares for one year after purchase, but we didn't need the money. We had a lot of income, so while we wouldn't be able to continue paying $1,000 a week into the mortgage, we could still get by with the share purchases and paying whatever we could throw into the mortgage after all the numbers were tallied. While I'm not a fan of purchasing individual shares, free money is free money. Well, it's "free" in most cases.

|

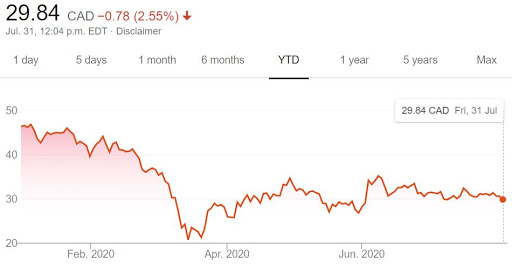

| 2020 YTD of wifey's old company's share price |

I took a look at the share price of her company and it's been a roller coaster. Wifey was eligible to first purchase shares in January of this year. In January, the price of one share was approximately $45. I calculated that if the share price dropped 25% to $34, we'd still come out ahead. Of course, we would have been dollar cost averaging if purchases were made as contributions were made. We were fortunate in that share purchases were done quarterly with wifey's first eligible purchasing period at the end of March. By the time April rolled around, the price of one share dropped to $29 and was as low as $18 during the lowest point. For us, that meant if the stock dropped to $22, we'd still break even. This only shows how unpredictable the stock market is. At the time I looked in January, the company share price hadn't been as low as $34 in a long, long time.

There was another share purchase at the end of June and shares were purchased again and the average cost of all of wifey's company shares was $30. Shortly after, wifey left her job.

Now that wifey was no longer an employee at her company, she was entitled to access her shares. There were two options presented to wifey. Sell her shares and get the proceeds paid to her bank account (also, triggering capital gains taxes) or transfer her shares to her brokerage account (thereby, avoid triggering capital gains taxes).

Since wifey wasn't able to participate in the ESPP for very long, she didn't have many shares. The average price of the shares was around $30.75 and with 205 shares at an average cost of $30, that means she will be on the hook to to pay approximately $30 in taxes ($153.75 in capital gains where 50% is taxable with an average tax rate of 30%, $153.75 x 0.5 x 0.3). The fees to sell the shares was approximately $60. In total, it would cost us $90 to sell the shares and transfer the proceeds to our bank account. That would be around $63.75 in gain, plus the 33% extra we received on wifey's contributions from the company. Not bad.

If I were to transfer the shares, we would avoid triggering the capital gains tax and avoid the fees from the brokerage. However, in order to transfer the shares, we would be charged $150 by Questrade to process the transaction. As there are technically two accounts (one for employee contributions and one for employer contributions), I think they would charge her $300 to transfer the shares. However, even in the best case scenario, wifey would be charged $150. It seems kind of ridiculous to open a brand new brokerage account (as she doesn't have a regular margin account at Questrade), mail in documents and whatever, just for $3.75 in profit. If you subtract the cost of the stamp, our profit would be $2.50. It just seems like a no-brainer to sell the shares at this point. If the fees are $300, then now we're getting into losses. We're still technically making money from the 33% employer contributions, but why pay money we don't need to?

In the end, after the calculations and speaking with wifey, we sold the shares. After one business day, the money was deposited into wifey's bank account where we used the money to pay down a portion of the mortgage, invest in ETFs (VCN and VXC in my margin account) and leave some money sitting in a bank account to purchase GICs in the future, assuming GIC rates (< 1 year term) ever exceed what we can get with a savings account at EQ Bank.

Overall, participating in the ESPP gave us a nice extra bonus.

Comments

Post a Comment